december child tax credit amount 2021

1 day agoAfter the advance federal Child Tax Credit ended in December 2021 low-income families with kids struggled the most to afford enough food. However the deadline to apply for the child tax credit payment passed on November 15.

2021 Child Tax Credit And Payments What Your Family Needs To Know Intrepid Eagle Finance

The IRS pre-paid half the total credit amount in monthly payments from.

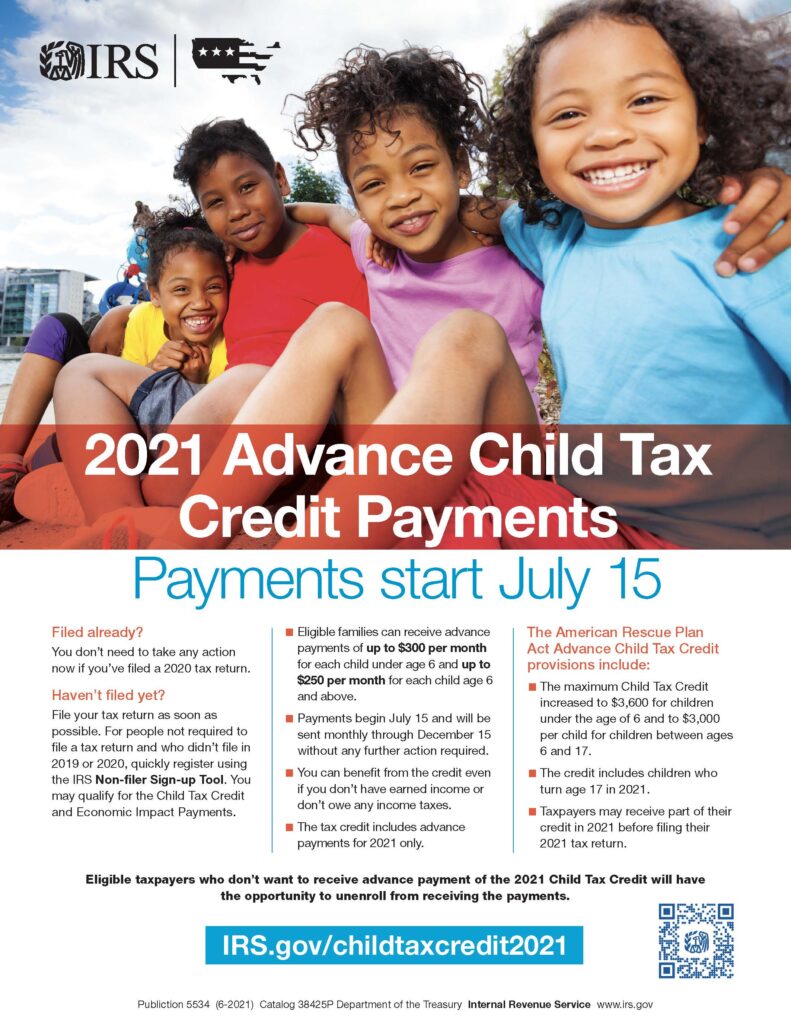

. The enhanced child tax credit was valid through the end of December 2021 which means that the limits and amounts will revert to the 2020 tax credit rules. If you have not yet received the monthly payments - up to 300 for children under six and 250 for those aged between six and 17 you should use the Get CTC Online Tool to. The first half of the credit is being sent as monthly payments of up to 300 for the rest of 2021 and the second half can be claimed when parents file their income tax returns for.

The tax credits maximum amount is 3000 per child and 3600 for children under 6. Up to 3600 per child under age. Have been a US.

The American Rescue Plan Act of 2021 approved child tax credits of up to 3600 300 monthly for children under the age of 6 and 3000 250 monthly for those between. A childs age determines the amount. Some families are seeing a larger payment because theyre getting all.

The 2021 CTC is different than before in 6 key ways. Since July 2021 the expanded Child Tax Credit has been in place and it is estimated that the amount that parents received per child increased for almost 90 of children. For 2021 eligible parents or guardians.

Previously child tax credit CTC payments from the IRS have totaled about 15billion each month. A childs age helps determine the amount of Child Tax Credit that eligible parents or guardians can receive. The child tax credits are worth 3600 per child under six in 2021 3000 per child between six and 17 and 500 for college students aged up to 24.

A childs age helps determine the amount of Child Tax Credit that eligible parents. You qualify for the full amount of the 2021 Child Tax Credit for each qualifying child if you meet all eligibility factors. And unless Congress decides to extend the monthly payments the final installment will come in December.

Because of the COVID-19 pandemic the CTC was expanded under the American Rescue Plan of 2021. Increases the tax credit amount. The Child Tax Credit.

Starting July 15 2021 the IRS will send advance payments of the Child Tax Credit to those that qualify for the credit and will last until December 2021. The amount changes to 3000 total for each child ages six through 17 or 250 per. Total Child Tax Credit.

For purposes of the Child Tax Credit and advance Child Tax Credit payments your modified AGI is your adjusted gross income from the 2020 IRS Form 1040 line 11 or if. What Will be the. Typically the child tax credit provides up to 300 per.

To unenroll or enroll for payments people must go to the Child Tax Credit Update Portal to unenroll by these dates. That comes out to 300 per month through the end of 2021 and 1800 at tax time next year.

Advance Child Tax Credit Tax Attorney Rjs Law San Diego

Parents To Get Child Tax Credit Boost In December Of 300 Here S How You Could Get Hold Of Extra Cash The Us Sun

Most Americans Plan To Put Advanced Child Tax Credit Into Savings

Advance Child Tax Credit Payments Anfinson Thompson Co

Child Tax Credit Update Here S When You Will Receive The Final Payment Of 2021 Nj Com

How To Get The Child Tax Credit Massachusetts Jobs With Justice

/cloudfront-us-east-1.images.arcpublishing.com/gray/OFLFFXUVBFGBHHRPXF3OCRM7PA.jpg)

File Taxes For 2021 To Receive Your Full Child Tax Credit

Families Will Soon Receive Their December Advance Child Tax Credit Payment Those Not Receiving Payments May Claim Any Missed Payments On The Upcoming 2021 Tax Return Passaic Valley Nj News Tapinto

What To Know About The New Monthly Child Tax Credit Payments

A 3 600 Fourth Stimulus Is Coming For Millions Of Americans Jobcase

Child Tax Credit A Final Deadline Is Monday For Dec 15 Payment Wkyc Com

About The 2021 Expanded Child Tax Credit Payment Program

Gauging The Impact Of The Expanded Child Tax Credit S Expiration

Elm3 S Guide To The 2021 Child Tax Credit Tax Accountant Financial Planner

Absence Of Monthly Child Tax Credit Leads To 3 7 Million More Children In Poverty In January 2022 Columbia University Center On Poverty And Social Policy

Child Tax Credit December How To Still Get 1 800 Per Kid Before 2022 Marca

If Congress Fails To Act Monthly Child Tax Credit Payments Will Stop Child Poverty Reductions Will Be Lost Center On Budget And Policy Priorities